Keeping a good credit score is essential since it is one to quite important points of monetary fitness. A good credit score support lenders be aware that you manage your borrowing from the bank sensibly and you will pay all the dues punctually. A top credit history may allow you to get lower rates of interest plus a quickly approved loan application. In order to maintain good credit, you must be familiar with conditions pertaining to credit rating, for example credit reports, credit reporting agencies, etcetera. We have protected everyone in this article. On top of that, you will observe more info on just what a credit score is, the way it try calculated and exactly how you can boost it so you’re able to rating a quick and you can problems-100 % free home loan.

What’s a credit history to have Mortgage?

Constantly, home financing includes a much bigger number compared to a good normal Car finance, otherwise people Personal loan. Therefore, assuming anybody can be applied getting home financing, the banks otherwise loan providers (known as loan providers) search for the fresh new creditworthiness of these personal. Banking institutions evaluate whether it is possible to give loans La Fayette you a mortgage so you can a candidate, according to their/their previous borrowing from the bank fees listing.

In the simple words, so it credit score assessment from the financial institutions is a lot like how exactly we give money to the family members according to the trust you will find on them, to your payment of your money because decideded upon. When we believe that person considering previous sense, we could possibly give him/the lady money. When we dont trust them getting payment of your own money, we would not give him or her money.

The credit score of your applicant is one of the biggest situations taken into consideration while giving your house Mortgage. You may click here to have more information toward other variables considered while considering the fresh new applicant’s eligibility for a mortgage.

Credit file v/s Credit history

A credit report reflects the credit history and you will purchases of individual; because the credit history is actually a number generated in line with the credit history.

The financing report try a keen thorough report that is actually boring and you may time-taking to read through. Whereas, the financing rating determined is definite and quantifiable suggestions that getting analysed inside the a standard means.

Interpreting a credit report can be personal sometimes, which may sometimes trigger not the right evaluation of one’s creditworthiness of men and women.

What exactly is an excellent Credit history to possess Financial?

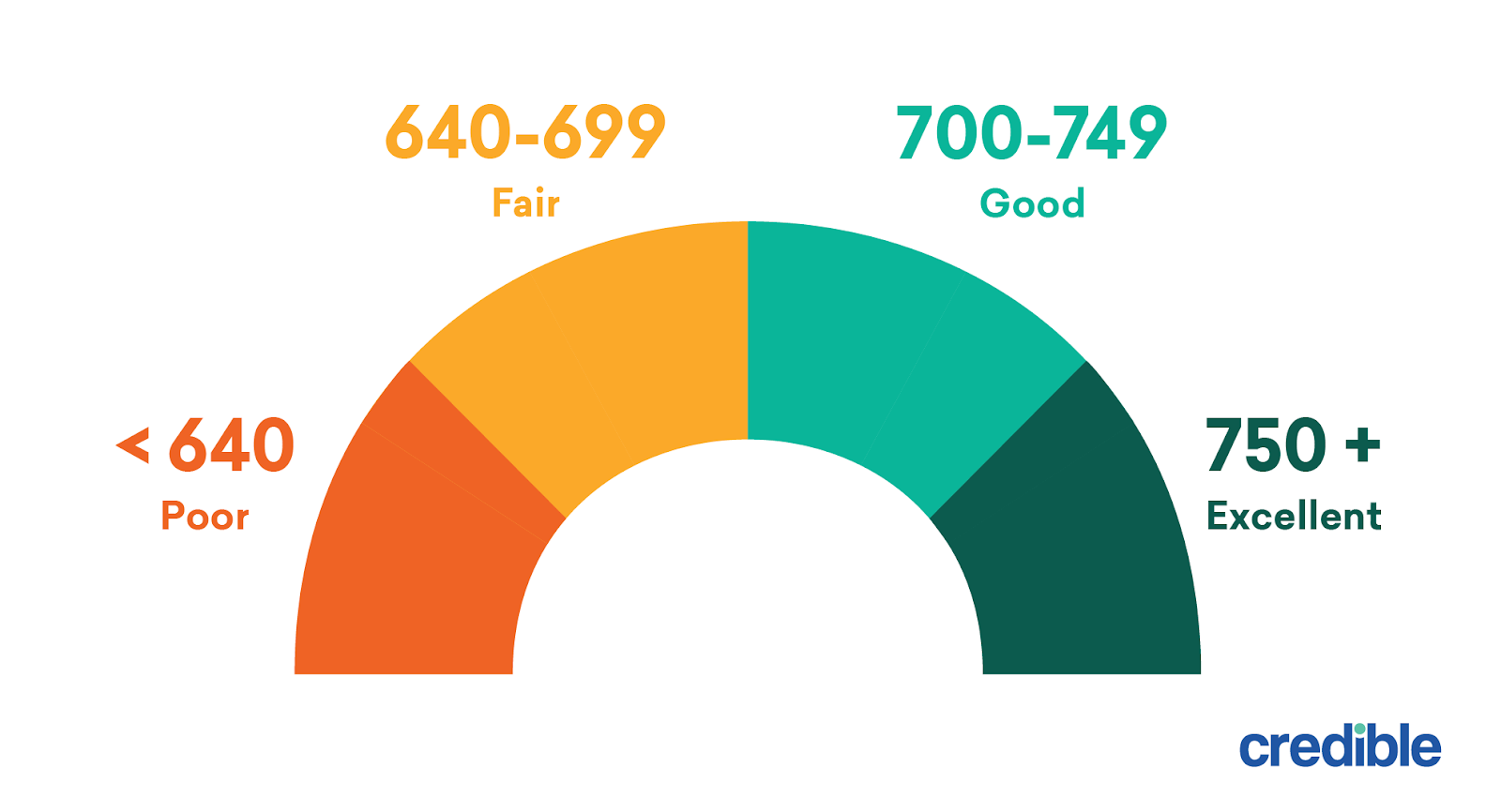

Credit score into the Asia ranges of 300- 900; having three hundred being the low and you will 900 being the higher. Which diversity is typical around the all of the major organizations getting fico scores getting home loans. So it get minimizes on account of numerous circumstances, many of which become:

- Large number of loans (also handmade cards) drawn

- Unusual EMI costs

- High amount of loan requests (no matter the newest sanction of the mortgage)

- Loan or charge card settlements designed for an amount cheaper than just extent due

- While, for many who reduce number of financing availed and used, and you may whom pay-off the finance and you can charge card fees regularly, the credit get grows.

If at all possible, is eligible for a mortgage, a credit score more than 700 is regarded as an excellent when you look at the Asia. People with a credit history throughout the listing of 650-700 are thought moderately high-risk and you can ount and you will/or higher interest levels than usual.

Yet not, a credit score less than 650 is high risk because of the loan providers and generally are unwilling to provide Financial so you’re able to such candidates. Which score are going to be fixed of the undertaking some steps, plus a standing ages of six-12 months before you apply for your loan.

Moreover, for some people with zero or minimal credit score available, the financing score could possibly get are normally taken for -1 to 6, based on the risk factor once the reviewed by credit file businesses. They might be: